At the beginning of 2020, Tyler Cowen brought forward a formulation for what he tentatively dubbed “state capacity libertarianism”. More than a few events of global significance have transpired since then, but the idea has remained in my head and has been spreading through the world of political economy. I have been meaning to engage with the concept and synthesize some of its precepts with my own view on political economy and the role of the state – versus the absence thereof – in crafting a “good” society.

I would recommend that anyone reading this piece read the outline of State Capacity Libertarianism (henceforth SCL) as outlined on Marginal Revolution. For those who do not choose to do so, and also to be up front about my own mental summary of what SCL means to me, I would summarize it as this: Cowen’s definition starts from the libertarian precept that the market should be largely free and should be the primary instrument for determining the allocation of resources within and between countries – and that the state should in general do no more than is necessary. Where Cowen’s definition breaks with this traditional libertarian minarchical view, however, is in taking a much more expansive view of what is “necessary”, seeing an important role for the state in subsidizing scientific research, financing megaprojects, and building and maintaining infrastructure. Cowen also sees SCL as having high state authority and capacity in enforcing its narrow responsibilities, and also is interventionist (or at least not anti-interventionist) about allying with or fostering kindred regimes around the world.

My own views come from a prior synthesis – a college leftist who went to work for the Oklahoma Department of Commerce, and interacted with the application and rationale of supply-side principles into the real world. In my time working for the government of one of the most pro-business states in the US, I learned that what most people want most is good jobs, and what job providers want most is a good workforce, a thing sadly missing in many areas that are most badly in need of jobs. For an area to have a good workforce it needs technical schools and universities to prepare the workforce, medical providers to keep them healthy, and infrastructure to get them to the jobs. I thus view the relationship between business and labor as inherently cyclical, with the role of the government in the economy to prevent stagnation and keep things moving dynamically. It is thus no surprise that one of the most highly sought tax incentive programs of the state essentially subsidized the education costs of aerospace engineers.

What I arrived at is a formula I would dub a kind of socially-minded neoliberalism or, to coin a decidedly inelegant term, “Growthcialism”: I too start from the highly evidenced proposition that a mostly free market and economic growth are of primary importance to societal wellbeing as well as the vitality and longevity of a nation-state. But I depart from the libertarian (and SCL) formula in thinking that the market and economic growth can and should be fostered by social programs that maximize economic efficiency, worker productivity, innovation and general economic dynamism. In one view, I am essentially a modern Hayekian, though with a leftist emphasis on Hayek’s view on the role of regulation and government interference. To wit, take this passage from Hayek that is often glossed over by modern Hayek fans:

“The successful use of competition does not preclude some types of government interference. For instance, to limit working hours, to require certain sanitary arrangements, to provide an extensive system of social services is fully compatible with the preservation of competition. There are, too, certain fields where the system of competition is impracticable. For example, the harmful effects of deforestation or of the smoke of factories cannot be confined to the owner of the property in question. But the fact that we have to resort to direct regulation by authority where the conditions for the proper working of competition cannot be created does not prove that we should suppress competition where it can be made to function. To create conditions in which competition will be as effective as possible, to prevent fraud and deception, to break up monopolies – these tasks provide a wide and unquestioned field for state activity”

Hayek, Road to Serfdom, 46

Despite these exceptions, on the whole, the historical evidence is clear that markets and capitalism are powerful without rival, and should be channeled rather than opposed. The success stories of East Asia in the 20th century are golden examples of the power of export-oriented, mostly capitalistic industrialization, though analyses such as Joe Studwell’s How Asia Works do illustrate an important role for active state intervention in such areas as land reform, export quotas, and a protected fostering of capital markets. However, that consensus seems most applicable to industrializing or industrial economies like those of East Asia in the mid-20th century. Observations of Northern European economies (Germany, Denmark) demonstrate that substantial social programs are not antithetical (and may be necessary preconditions) for growth and competitiveness in post-industrial economies.

To discuss one area where I disagree with SCL, consider Cowen’s[1] hand-waving dismissal of social programs with the curt phrase “demands of mercy are never ending”. Social programs viewed through the “growthcialism” lens are not mercy – they are net benefits to the overall economy. They improve the quality of the workforce, they distribute costs associated with goods that have distributed benefits (such as health and education), and they improve things like labor mobility, an underrated measure of overall labor market health. In this way they work exactly like small-scale megaprojects, which Cowen/SCL openly embrace. One of the many touted pro-libertarian benefits of UBI is its supposed ability to liberate people to pursue their dreams, to innovate with startups, learn new trades, or tinker away at inventions. The same holds true at least in part for programs that free people from the need to work through college to pay for tuition, or that allow people to quit their jobs without fear of losing medical coverage.

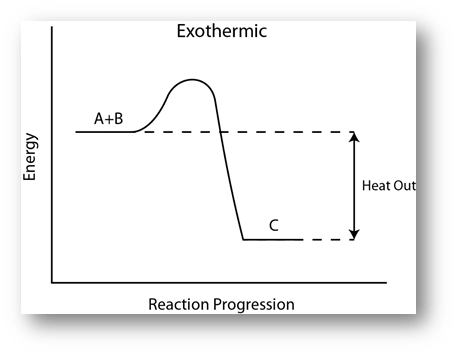

To tangentially segue, I began my university education in Chemical Engineering, and I have always maintained an engineer’s viewpoint when addressing questions of political economy. I find that good social program and megaprojects work very similarly to the chemistry concept of Activation Energy: sometimes a chemical reaction is primed to happen and would be able to sustain itself once it begins occurring, and indeed would generate a net output of energy, but it requires some sort of exogenous “push” to get the ball rolling (a mundane metaphor would be a boulder at the top of hill that just needs a jolt to get rolling).

A worthwhile megaproject or social program is like an exothermic reaction – even though the initial cost may be prohibitive for some actors, once it is overcome the net output can be highly positive

Megaprojects like the interstate highway system, Hoover Dam, Manhattan project, Apollo Program or national broadband can have prohibitive startup costs that even the largest private corporations would struggle to justify maintaining on their balance sheets for years, even if on the scale of decades they are clear economic winners.[2] For governments, however, these costs are often drops in the bucket, and investments in national wellbeing do not have to be recouped directly; growing GDP is often justification enough for investments in the minds of bondholders. If SCL advocates see megaprojects as beneficial, why does a college education, effectively a megaproject in the life of an individual, not count as a mass-distributed megaproject? Why does the same logic not apply?

In short, Growthcialism also starts from the libertarian precept of the power of the market and the immense social good of economic growth, though with some caveats about the market taken into account.[3] However, the SCL still shares with classical libertarianism a core false assumption about human nature, the idea of a homo economicus capable of making rational calculations about things like healthcare and education. The problem is that homo sapiens often has trouble calculating things that involve such factors as social standing, present-versus-future utility, etc. High upfront cost of education or medical treatment may never at any one point be worth it compared to a slow trickle of marginally lower productivity or earnings over a lifetime, and we are all familiar with the reasons why medical treatment does not obey the traditional assumptions of supply and demand.[4] The state has an active role to play in transforming those high upfront costs into low lifetime costs via tax-funded public financing of health and education.

Coming as I do from a left-leaning perspective (meaning that my median policy position falls on the left of the American political spectrum, though I have opinions (and follow academic consensuses) that fall all over the map), SCL presents an interesting alternative model to the libertarianism I have grown up knowing and rejecting– and indeed, it presents a model of libertarianism that is steelmanned and harder to assail. And if SCL is the rival to a left-leaning welfare state and this is the dialectic for the creation of new sociopolitical regimes around the world, I think the world will be better for it. However, these are changing times, and populism and nationalism are infusing national politics around the world, from the US to the EU even unto China. Increasingly, governments are pressured to be interventionist and responsive, to embrace democratic legitimacy over rationality and science, as the state is forced into a mode of reactivity against a public armed with ever more powerful hooks and levers (a la Martin Gurri). My fear is that unfortunately both Growthcialism and State Capacity Libertarianism are naïve idealist views, and that politics, as usual, will find a way to screw everything up.

[1] It is (perhaps intentionally) ambiguous whether Cowen is describing his own views. However, as Cown has in the past described himself as libertarian, and says that “smart libertarians” have gravitated to SCL, it seems a safe assumption that Cowen is attempting to codify his own views via the coining of this term. What’s the Straussian reading, as Cowen would say?

[2] and private corporations might struggle to actually harvest the diffuse economic benefits.

[3] For me the primary errors of market fundamentalism are that 1, need is not concomitant with ability to pay; and that 2, need (defined as real material benefit of a good or service) is not coterminous with want (the perception of material benefit of a good or service), the decoupling of these being the entire foundation of the field of marketing, to the end of being able to inflate the latter.

[4] Urgency, lack of transparency, possibility of complications, high barriers to entry, etc