Chinese manufacturing policies are unsustainable. That doesn’t mean they won’t accomplish China’s goals.

The Chinese economy has been drawing contradictory comments in recent months. Amidst the gloom and doom of prognosticators declaring that the Chinese economic engine may finally be stalling, there is the new and sudden alarum about the flood of cheap Chinese exported goods that are now overwhelming global markets. While these opposing narratives may seem incompatible – how could a stalling economy be so productive and competitive? – they are actually very closely related. China may be pursuing a stimulus strategy that I liken to a coral reef: though many subsidized companies will fail, their skeletons will scaffold the success of China’s future industrial titans.

The Disease

On the one hand, it is incontrovertible that the Chinese economy is not what it once was. Property giants are imploding, Chinese outbound tourist numbers have not recovered to pre-pandemic levels, and the deflationary cycle of low consumer confidence threatens a long malaise. Chinese economic growth, even according to the official numbers, is clearly in a new low-growth mode, one deemed by the Economist as “economic Long Covid”.

The Uniquely Chinese Cure

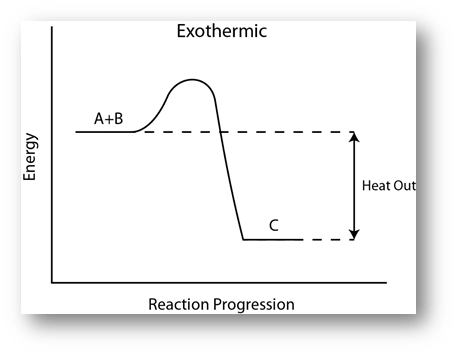

But the way in which China is choosing to address this crisis is showing some signs of success, and is the result of Xi Jinping’s unique ideological outlook. Under Xi, the Chinese Communist Party has begun a slow return to its socialist ideological roots and sought a different form of stimulus than the standard prescription other economies would employ. In most of the world, the textbook response to a slowing economy would be a Keynesian, demand-side stimulus meant to put money into consumers’ pockets and jumpstart spending, keeping the economic engine moving – think of the American “stimulus checks” cut under Obama in 2009 or Trump and Biden during the pandemic in 2020-21. Xi Jinping and his tongzhi, however, view that kind of stimulus as capitalist decadence, fearing that any direct payments to individuals from the government would precipitate the kind of needy indolence that western conservatives love to lambaste (just one of the many ways in which Chinese governance is actually quite right-wing on the western spectrum). They refuse to pursue that textbook route. In seeking a resolution to the policy dilemma, the PRC has decided to use a variation on the same stimulus strategy they used during the 2008-9 crisis, which then injected money into local governments, construction programs, and large industrial corporations. The hope was then, as now, that by tying access to stimulus funds to jobs and industry, individual citizens would be compelled to go out and be productive, stimulating the old-school Maoist spirit of nationalist industriousness. At the same time the government could make long-term investments in critical areas like infrastructure and industrial technology.

This time around, instead of injecting money into bloated and debt-ridden local governments and construction sectors, China is focusing on what it sees as the future: high-tech export-oriented manufacturing, with a clear emphasis on electric vehicles.

“In June last year, China introduced a 520 billion yuan ($71.8bn) package of sales tax breaks, to be rolled out over four years. Sales tax will be exempted for EVS up to a maximum of 30,000 yuan ($4,144) this year with a maximum tax exemption of 15,000 yuan ($2,072) in 2026 and 2027.

According to the Kiel Institute, a German think tank that offers consultation to China, the Chinese government has also granted subsidies to BYD worth at least $3.7bn to give the company, which recently reported a 42 percent decrease in EV deliveries compared with the fourth quarter of 2023, a much-needed boost.”

–https://www.aljazeera.com/economy/2024/4/20/are-chinese-evs-taking-over-the-car-market

Beyond these significant numbers, EU and US policymakers suspect even larger, undisclosed boost from the Chinese government (particularly debt-driven incentives from local governments), prompting official investigations and declarations, and an even an official Chinese acknowledgement of industrial overcapacity was real – a claim that Premier Li Qiang later reversed course on.

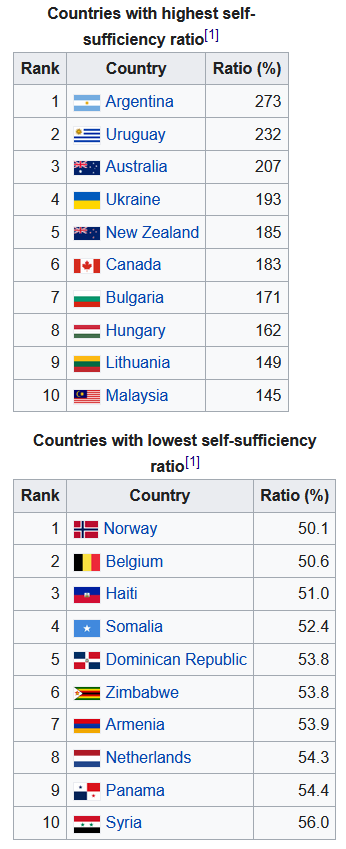

The finger-pointing and blame game dynamics aside, the policy is not sustainable. Whether the subsidies are paid for by local government debt or by spending down of China’s cash reserves, or whether these industries are truly competitive, having large, tax-free industries is not sustainable for China fiscally, and in any event not acceptable for the world marketwise: “China is now simply too large for the rest of the world to absorb this enormous capacity” stated US Treasury Secretary Janet Yellen. In short, the world was unprepared to prevent the first China Shock, but will not accept a second one. Eventually, there will be a reckoning of China’s industrial overcapacity, many unprofitable zombie firms will close, and global markets will react as they deem necessary.

The Coral Reef Economy

There are two ways to understand the current dilemma. The first way is to assume that Chinese policymaking is a shortsighted reaction to a slowing economy and that policymakers did not anticipate the global backlash. The second is to think that policymakers took these steps despite these obstacles because there was a longer-term goal in mind. What, then, might that longer-term goal be? I find the analogy of a coral reef to be potentially helpful here. Though coral reefs are huge rocky structures, corals themselves are small living animals. In their deaths, the skeletons they leave behind make up the structure of the reef itself and remain useful to their successors, serving as scaffolds, the reef as a whole growing fractally upwards and outwards on the bones of the corals’ ancestors. Likewise, the Chinese EV push may be hoping for a similar outcome: although most of the current EV manufacturers will not survive once debts are called in, stimuli are removed and global markets harden, their skeletal infrastructure will remain in place to serve their kin: skilled workers, upstream supply chains, downstream market and aftersales contracts, distribution networks, and most importantly technical innovations, will remain in place and can be bought out and more efficiently utilized by the (as China perhaps hopes) handful of surviving EV manufacturers who can, like corals, use the skeletons of their comrades to grow upwards and outwards. Furthermore, growing corals compete with other coral species for space, and an EV sale by a Chinese company, even a company destined for failure, is one fewer sale for a non-Chinese EV company. The Chinese “surge” in EV exports are not just beneficial for China directly, but, in China’s zero-sum vision of global competition, are indirectly beneficial for China by depriving rivals of the same sale, suffocating the competitiveness of the Teslas and Volkswagens of the world. The reef after the stimulus-fueled surge will be one in which the surviving Chinese companies can reign supreme.

I will not argue that the second analysis is indeed the perspective of PRC policymakers, or even if it is that the “coral reef” scenario will play out as outlined here. Many would argue that China’s policy responses are indeed short-sighted and reactive, and that only the long-promised shift to higher consumer spending will guarantee China’s long-term financial stability and comfortable integration into the global political economy. But it is difficult to deny that Chinese EV manufacturing has made impressive leaps in both technology and capacity in recent years, and regardless of the fate of the current market situation, it seems likely that at least a few such manufacturers will remain globally competitive in the long term.